Finance Butik Compra

Build a diversified real estate portfolio

With our selected opportunities for industrial micro-flex and luxury residences

10-20%

Variable annual return

And USD

Luxury Properties

Commercial Properties

Finance Butik Compra

Properties in

Preconstruction

From US$500,000

Earn income in US dollars

Earnings are generated monthly from net operating profits when the property is in operation and capital gains when it is sold.

Invest like an expert

Our rigorous origination, meticulous selection, and exhaustive due diligence processes ensure excellent returns and investor satisfaction.

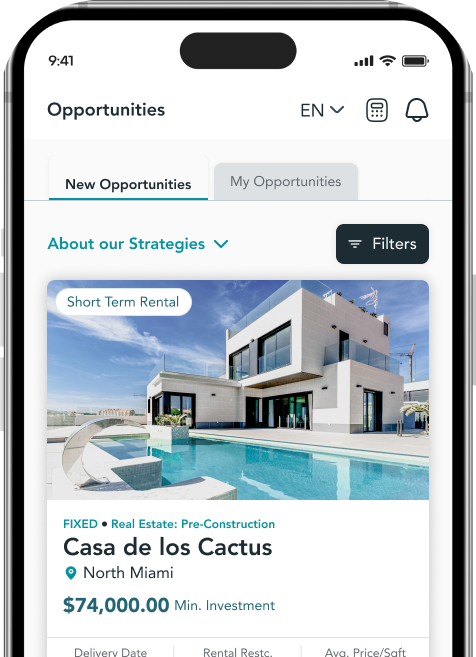

Pre-construction or Ready to Rent

Pre-construction opportunities offer the greatest potential for appreciation. Ready-to-rent properties generate immediate income without construction risk.

Hassle-free ownership

Our dedicated team will maintain and manage your property for you. We optimize your investment using advanced, data-driven technology to improve pricing and occupancy.

A home away from home in Miami

Enjoy your property whenever you want, just like a second home. We'll rent it out for you when you're away.

Current Opportunities

BUY

Delivery

2027

Conditions

LTR/STR

Price / Square Foot

$1,069

The Standard Residences

Miami, FL

$525,000

Min. investment

BUY

Delivery

Q1 2028

Conditions

LTR

Price / Square Foot

$1,573

The Well

Miami, FL

$1,400,000

Min. investment

BUY

Delivery

2028

Conditions

LTR

Price / Square Foot

$1,509

Now by Your Home

Miami, FL

$990,000

Min. investment

BUY

Delivery

Early 2028

Conditions

LTR

Price / Square Foot

$1,788

Mercedes Benz

Miami, FL

$1,300,000

Min. investment

Financial Boutique Purchase Benefits

Personal Warehouses in Hot Spot Markets around the USA

Starting at US$400,000

Earn income in US dollars

Earnings are generated monthly from net operating profits when the property is in operation and capital gains when it is sold.

Invest like an expert

Our rigorous origination, meticulous selection, and exhaustive due diligence processes ensure excellent returns and investor satisfaction.

Pre-construction or Ready to Rent

Pre-construction opportunities offer the greatest potential for appreciation. Ready-to-rent properties generate immediate income without construction risk.

Stable income with triple net leases

Tenants tend to stay for long periods and renew their leases. They pay property taxes, building insurance, maintenance, rent, and utilities, and you enjoy a predictable stream of consistent rental income.

High-yield markets

We acquired units in areas of high population and job growth within the U.S. Sunbelt region, starting with Texas and Florida.

Current Opportunities

BUY

Delivery

Q1 2025

Conditions

LTR

Price / Square Foot

$465

Personal Warehouse

Dripping Springs, TX

$465,000

Min. investment

BUY

Delivery

Ready

Conditions

LTR

Price / Square Foot

$257

Personal Warehouse

Alpharetta, GA

$515,700

Min. investment

BUY

Delivery

Ready

Conditions

LTR

Price / sqft

$317

Personal Warehouse

Castle Rock, CO

$433,000

Min. investment

BUY

Delivery

June 2024

Conditions

LTR

Price / sqft

$282

Personal Warehouse

Buford, GA

$844,000

Min. investment

What is your goal?

01

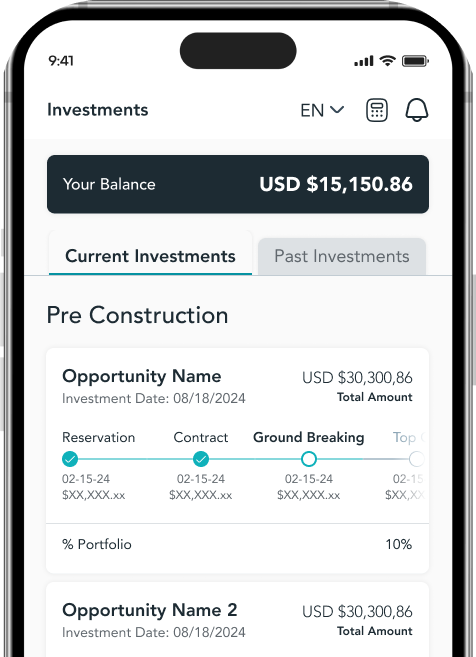

Building Wealth with Preconstruction Properties

Investing in pre-construction real estate is a strategy typically designed for people looking to build long-term wealth. Investing in real estate during the pre-construction stage offers three key benefits.

First, the entire investment doesn't have to be made at once; instead, payments are spread out over key development milestones, facilitating cash flow.

Secondly, you secure the purchase price from the outset, allowing you to benefit from the appreciation in value as the project progresses. In markets like the United States, where property appreciation is a key factor in profitability, this can be a significant advantage for investors.

Third, the earlier you invest in the project, the greater the discount you'll enjoy.

02

Generate income with rental-ready properties

Investing in rental-ready properties is ideal for those looking to generate immediate passive income.

With this type of investment, you can start renting out the property immediately after purchase, allowing you to receive rental income from day one. This makes it an excellent option for investors who want cash flow from the start, rather than waiting until a project is completed.

Ready-to-rent properties also allow for faster returns and fit well into a strategy focused on generating income rather than solely long-term appreciation.

Access the most profitable markets in the USA

Florida

South Florida is setting a new trend, not only in the real estate market, but more importantly, as an economic cluster. Among all U.S. cities, Miami is overlapping the most efforts that have existed in different economic hubs for many years.

The impressive coordination between the private sector and government participation, surrounded by cultural, artistic, commercial, and entertainment industries, has driven exponential growth in the economic pillars of a highly attractive investment center. Its strategic location contributes to the city's economic diversification and reinforces its importance as a key commercial hub for the continent.

Texas

Real estate trends in Texas have been very positive in recent years. The state has experienced steady population growth, with many people moving to Texas from other states in search of job opportunities, a lower cost of living, and a desirable quality of life.

According to a report from the Texas Real Estate Research Center, the state added more than 300,000 new residents in 2020 alone and is expected to continue experiencing population growth in the coming years. The Texas real estate market is seeing increasing popularity for certain types of properties, such as single-family townhomes, estate homes, and condos.

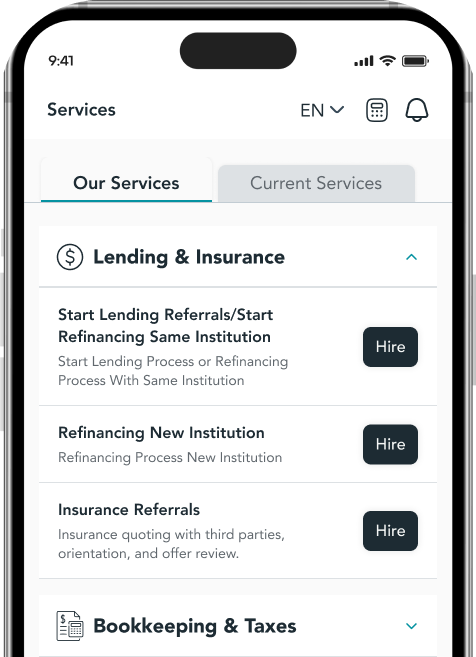

Meet Lua Host

Lua Host, by Finanz Butik, is a unique property management company offering both short-term and traditional management services. We offer a wide range of services, including utility management, maintenance, and long-term leases in key U.S. cities.

With Lua Host Property Management, you can grow your real estate portfolio while we take care of all your needs, maximizing your passive income, whether as a short-term rental property or as a second home in the U.S.

1

A white-glove service with local hotspot teams ready to take care of your property and your guests.

Premium Local Management

2

We use cutting-edge, data-driven technology to optimize revenue.

Smart revenue optimization

3

Our marketing tools will make your property shine on the best listing tools, attracting the best guests and improving occupancy rates.

Maximized visibility and bookings

Our Process

Access highly selected, institutional-quality real estate investments with Finanz Butik

Search

Our mission is to partner with the best real estate investment managers in every market sector.

Solid investments

We seek partners with the infrastructure and institutional capabilities to minimize risk and optimize returns for our investors.

Follow-up

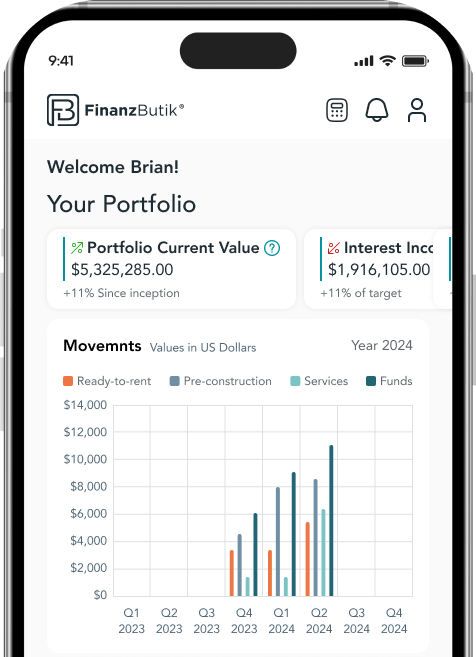

With our platform, investors can track all their investments in one place, access new opportunities, and stay up-to-date with reports.

How do I start investing in Purchase?

01

Create your account

Tell us about your investment experience, goals, and preferences so we can personalize your investment experience.

02

Choose your preferred property

We'll create a customized real estate investment portfolio to suit your unique circumstances and needs.

03

Explore our services

Add any of our premium services for hassle-free management of your real estate business and asset portfolio.

04

Grow your portfolio

Receive passive income and monitor your portfolio's performance from the Finanz Butik app.

Sold Properties

BUY

Delivery

Delivered

Conditions

LTR

Price / sqft

--

Aston Martin Residences

Miami, FL

Min. investment

$900,000

BUY

Delivery

Delivered

Conditions

STR

Price / sqft

$1,200

600MWC

Miami, FL

Min. investment

$500,000

BUY

Delivery

Delivered

Conditions

sTR

Price / sqft

$986

Yotel Pad

Miami, FL

Min. investment

$440,000

BUY

Delivery

Delivered

Conditions

--

Price / sqft

$329

Personal Warehouse

Fort Collins, CO

Min. investment

$581,360

Invest in institutional-grade real estate

Strategic alliances, strategic capital

Finanz Butik creates strategic alliances with experienced developers in target regions and sectors. We invest our capital alongside their expertise to deliver returns to our investors.

Explore high-quality real estate opportunities from trusted sources.

Frequently Asked Questions

We believe in clear and simple investments. Explore our FAQs and, if you need more information, don't hesitate to contact us anytime.

Can Latin American investors buy real estate in the United States?

Yes, Latin American investors can purchase real estate in the United States through our services at Finanz Butik, your one-stop shop for all your real estate investment needs, including property management with Lua Host. There are no restrictions on foreign ownership, whether for residential or commercial real estate.

What types of properties can I invest in?

At Finanz Butik, we offer a wide range of property investment options, including residential homes, commercial buildings, vacation homes, and rental properties, all tailored to your investment goals and budget. We're here to help you find the right property.

What criteria are used to evaluate a property's investment potential?

The criteria used to select development projects with Finanz Butik include a combination of factors that ensure a unique boutique experience. These factors include location desirability, market demand, potential for value appreciation, architectural uniqueness, and our commitment to providing exceptional customer experiences.

What additional costs should I consider when investing in a property?

When investing in a property, it's essential to consider expenses such as insurance, HOA dues, property taxes, maintenance, and other costs specific to your investment. These are key to efficient management and the protection of your assets. At Finanz Butik, we're here with you every step of the way so you can invest with confidence.

What property management services does Finanz Butik offer?

Finanz Butik offers comprehensive property management services through its subsidiary, Lua Host. We cater to both short- and long-term needs, ensuring your property is well-maintained regardless of the length of your lease. Our services include maintenance, cleaning, and frequent inspections to keep your property in top condition. We offer closing support and dedicated services for a smooth setup, along with regular quarterly and monthly reports to keep you informed about your property's performance. Our services are designed to simplify real estate ownership and maximize returns.

What is property appreciation?

Property appreciation refers to the increase in the value of real estate assets over time. Investors anticipate generating profits from this appreciation when selling the property, making it a key consideration in real estate investment strategies.

What taxes do I have to pay as a property owner in the USA?

As in any market, acquiring a property generates rights and obligations; in the American market, property owners must pay a property tax, which varies depending on the state and type of property acquired.

What returns can I expect?

Returns vary depending on the property and investment type, with typical ranges between 5% and 16%.

What are the risks?

As with any investment, risks include market fluctuations, tenant vacancies, interest rate changes, and property management challenges. Our team conducts extensive due diligence to mitigate these risks.

Can I invest through a company or LLC?

Yes, you can invest through a business entity or LLC.

Can I invest with a partner?

Yes, joint investments with partners are permitted.

Who cannot invest?

Restrictions may apply based on regulatory requirements. Consult our team for more details.

What types of properties are available?

We offer investment opportunities in: Pre-construction projects, Luxury residences and Light industrial properties

What is a triple net lease?

A triple net lease (NNN lease) is a commercial contract where the tenant pays property taxes, insurance, and maintenance costs, in addition to rent. This structure provides investors with passive income with minimal landlord management, making it ideal for long-term investments.

What are the benefits of investing in micro-flex industrial properties?

Micro-flex industrial properties offer stable income through Triple Net (NNN) leases, where tenants cover taxes, insurance, maintenance, and utilities in addition to rent. Furthermore, leases are typically long-term, reducing turnover and vacancy risk. We focus on growth markets within the U.S. Sunbelt, such as Texas and Florida, with the potential to expand into other states through our strategic partners.

When will I receive payments or income?

Payments depend on the specific investment, but are generally distributed monthly or quarterly.

Do I have to pay taxes or file tax returns on the profits generated by my property?

Tax obligations depend on your residency and investment structure. Most of our investments are designed to minimize U.S. tax withholding for non-resident investors. We recommend consulting a tax advisor for specific guidance.

Can investors access detailed information about listed properties, such as location, specifications, and potential returns?

Yes, you can find this information in your investment portal by clicking on your properties and selecting "view details."

How does property financing work for foreigners?

Accessing mortgages and insurance for foreigners can present certain challenges. However, thanks to our relationships with credit and insurance institutions, we connect our clients with customized solutions to facilitate financing and protect their investments.

How do I start investing with Finanz Butik?

To begin your investment journey with Finanz Butik, follow these simple steps:

Other Investment Products

Your Simplified Real Estate Portfolio

With us, you can develop an asset portfolio that goes beyond a simple real estate investment. We offer diversified opportunities, customized strategies, and access to key sectors to maximize your growth and profitability.

Buy

5-16%

Variable Rate

Invest in properties and generate rental income.

Variable

Variable

US$400,000 minimum

Fixed-income investment backed by real estate.

FB Cash

5-8.8%

Fixed Rate

Terms: 6 months to 2 years

Quarterly Payment

From US$15,000

Invest by lending with mortgage collateral, backed by real estate.

Pay attention

8-11.5%

Variable Rate

Terms: 2 to 3 years

Quarterly Payment

From US$5,000

Invest with the most prominent US developers.

Develops

20%+

Variable Rate

Terms: 3 years

Variable Payment

From US$100,000

0%-8% Income

(Cash Flow)